-

Are you headingAbout UsWe are here to helpin the right financial direction?

Are you headingAbout UsWe are here to helpin the right financial direction? -

We are with youWhen we can helpof life's journey.along the way

We are with youWhen we can helpof life's journey.along the way -

We want to understandOur servicesand provide you with strategies to help you achieve your goals.what you want to achieve

We want to understandOur servicesand provide you with strategies to help you achieve your goals.what you want to achieve

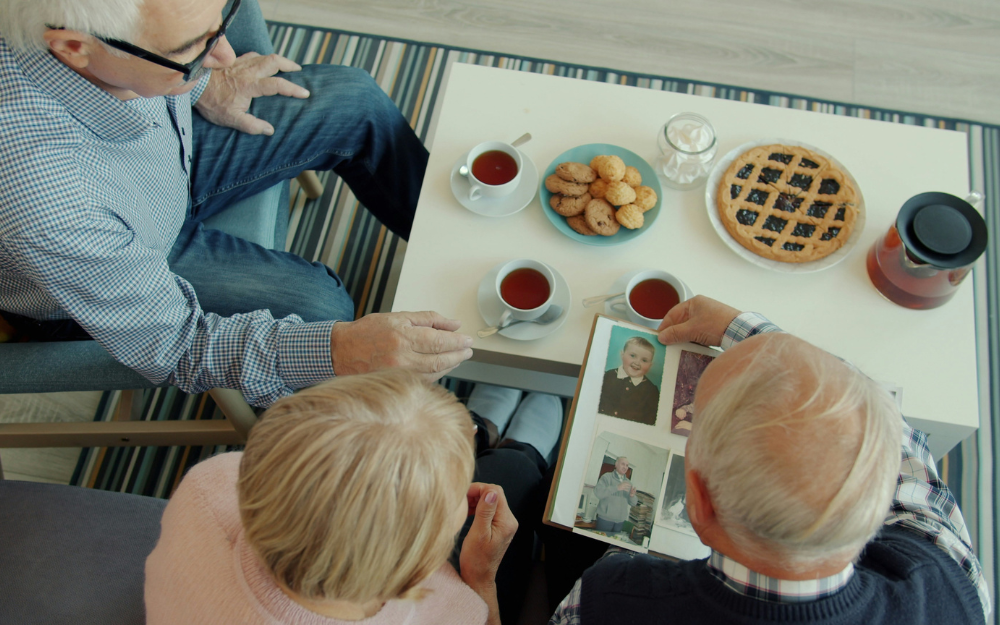

With you along the way

At Premium Business Group, our team of qualified Financial Advisers works alongside you throughout your life – from building your career to starting a family, and planning your lifestyle after you’ve finished work.

Our business is your financial wellbeing. We provide advice and solutions from the basics of building wealth through to estate planning – and everything in between.

Superannuation

Wealth Protection

Retirement Planning

Debt Management

Estate Planning

SMSF

Superannuation

What is superannuation?

Superannuation (or super) is a fund specifically designed to help you save and invest for your retirement. It’s restricted as you generally can’t withdraw from super until you retire or reach your preservation age (that’s the intention, although there are special conditions of release). And super funds are set up as trust funds. This means a trustee is appointed to manage the fund on behalf, and for the benefit, of its members. Super receives special tax treatment compared to your other money. When it comes to investing over the long term, there aren’t many better tax-effective ways to save for your retirement. Lower taxes and more investment options – such as local and international shares, property and fixed interest investments – offer your super more potential to grow.

Why do I need super?

- Super is compulsory for employees. Superannuation Guarantee (SG) contributions** were introduced to help us take control of our retirement.

- The next step is to use our AMP super simulator to see how you’re tracking and determine what strategies you can use to reach your goals.

** Deposits into a super fund are called contributions.

Advantages of super

Super opens your money to the world of investment markets and you can choose how it is invested. Money in super is taxed in different ways to your other investments. It’s designed to reward you for investing for the long term. Your insurance premiums, which are part of your super contributions, may be paid from your pre-tax salary, which is a tax-effective way to enjoy the protection you and your family need.

How does my super work?

The most common type of super is an accumulation fund, which is like a managed fund or investment. The main difference is the advantageous tax treatment on contributions and earnings which your money enjoys until you retire. If you have a lot of assets and have the time, you may want to consider a self-managed super fund to take control of your super.

Making a contribution

Deposits into super are known as ‘contributions’. There are two types of contributions. They can be made from your:

- pre-tax income (concessional contributions) and

- post-tax income (non-concessional contributions).

Generally, concessional contributions (made from pre-tax income) attract a contributions tax of 15%, which can be significantly lower than your marginal tax rate. Tax on non-concessional contributions (made from post-tax income) does not apply. However, there are caps on both these types of contributions which vary depending on your age.

Benefits

- Earnings in super are taxed at up to 15% (and only 10% on capital gains), which is lower than most people’s marginal tax rate. If you start a pension at retirement then the tax on earnings in super reduces to nil.

- If you withdraw after age 60 your money is tax free.

- You can withdraw your super balance (the benefit) when you reach your preservation age. This varies depending on your birth date. By 2025 everyone will have a preservation age of 60.

- There are different tax treatments on lump sum payments depending on the size of the benefit and the age and service period of the member.

- Money invested after July 1999 is fully preserved, which means it can’t be accessed until you reach your preservation age.

More flexibility

- Super is becoming more flexible with more strategies and ways to reach your retirement goals:

- The government’s co-contribution scheme is designed to help low to middle income earners get more into their super.

- Concessional contributions can be used to reduce your tax.

- A transition to retirement strategy means you can still work full time or part time after your preservation age and still contribute to your super.

- Self-managed super funds allow you to take even more control of your super.

Premium Business Group, Financial Planners in Hobart provide superannuation advice. Contact us on 03 6165 2666.

Superannuation

Superannuation is a way to save for your retirement. You build up super while you are working to make sure you can have a comfortable retirement.

Read More....

Superannuation

What is superannuation?

Superannuation (or super) is a fund specifically designed to help you save and invest for your retirement. It’s restricted as you generally can’t withdraw from super until you retire or reach your preservation age (that’s the intention, although there are special conditions of release). And super funds are set up as trust funds. This means a trustee is appointed to manage the fund on behalf, and for the benefit, of its members. Super receives special tax treatment compared to your other money. When it comes to investing over the long term, there aren’t many better tax-effective ways to save for your retirement. Lower taxes and more investment options – such as local and international shares, property and fixed interest investments – offer your super more potential to grow.

Why do I need super?

- Super is compulsory for employees. Superannuation Guarantee (SG) contributions** were introduced to help us take control of our retirement.

- The next step is to use our AMP super simulator to see how you’re tracking and determine what strategies you can use to reach your goals.

** Deposits into a super fund are called contributions.

Advantages of super

Super opens your money to the world of investment markets and you can choose how it is invested. Money in super is taxed in different ways to your other investments. It’s designed to reward you for investing for the long term. Your insurance premiums, which are part of your super contributions, may be paid from your pre-tax salary, which is a tax-effective way to enjoy the protection you and your family need.

How does my super work?

The most common type of super is an accumulation fund, which is like a managed fund or investment. The main difference is the advantageous tax treatment on contributions and earnings which your money enjoys until you retire. If you have a lot of assets and have the time, you may want to consider a self-managed super fund to take control of your super.

Making a contribution

Deposits into super are known as ‘contributions’. There are two types of contributions. They can be made from your:

- pre-tax income (concessional contributions) and

- post-tax income (non-concessional contributions).

Generally, concessional contributions (made from pre-tax income) attract a contributions tax of 15%, which can be significantly lower than your marginal tax rate. Tax on non-concessional contributions (made from post-tax income) does not apply. However, there are caps on both these types of contributions which vary depending on your age.

Benefits

- Earnings in super are taxed at up to 15% (and only 10% on capital gains), which is lower than most people’s marginal tax rate. If you start a pension at retirement then the tax on earnings in super reduces to nil.

- If you withdraw after age 60 your money is tax free.

- You can withdraw your super balance (the benefit) when you reach your preservation age. This varies depending on your birth date. By 2025 everyone will have a preservation age of 60.

- There are different tax treatments on lump sum payments depending on the size of the benefit and the age and service period of the member.

- Money invested after July 1999 is fully preserved, which means it can’t be accessed until you reach your preservation age.

More flexibility

- Super is becoming more flexible with more strategies and ways to reach your retirement goals:

- The government’s co-contribution scheme is designed to help low to middle income earners get more into their super.

- Concessional contributions can be used to reduce your tax.

- A transition to retirement strategy means you can still work full time or part time after your preservation age and still contribute to your super.

- Self-managed super funds allow you to take even more control of your super.

Premium Business Group, Financial Planners in Hobart provide superannuation advice. Contact us on 03 6165 2666.

Retirement Planning

Transitioning into retirement

You no longer have to retire on the day you turn 65. The day you stop working is now in your hands. By using a Transition To Retirement strategy you can take control of your retirement date, prolong your retirement or use it to turn a redundancy into a time of opportunity.

Managing your retirement

Reaching your retirement is a significant milestone, and it’s important you live the life you want to. There are still many ways to make the most of this stage of your life and you might have a few questions.

- Where should I invest my money?Should you leave it in super or start an income stream? Take the annuity or pension? How good are Retirement savings accounts?

- Make your money last Do you have the right asset mix? And have you structured your finances to maximise government benefits? And what’s the best way to manage your debt?

- Do I pay tax in retirement? It depends on how the money went into your super, how you take money out and how old you are. We look at ways to minimise the tax impact.

- How much can I withdraw from super? What are the minimums and maximums you need to be aware of.

- Preparing for residential careLooking for aged care can be difficult and there’s lots to consider. Being aware means being prepared.

- Estate planningGood estate planning isn’t just about making a will. It’s a good way to take stock of your finances. Read more

For retirement planning advice in Hobart contact Premium Business Group on 03 6165 2666.

Retirement Planning

Retirement may seem like a long way off but putting money into super now is still a tax effective way to invest your money. You also can benefit from the effects of compounding returns.

Read More ....

Retirement Planning

Transitioning into retirement

You no longer have to retire on the day you turn 65. The day you stop working is now in your hands. By using a Transition To Retirement strategy you can take control of your retirement date, prolong your retirement or use it to turn a redundancy into a time of opportunity.

Managing your retirement

Reaching your retirement is a significant milestone, and it’s important you live the life you want to. There are still many ways to make the most of this stage of your life and you might have a few questions.

- Where should I invest my money?Should you leave it in super or start an income stream? Take the annuity or pension? How good are Retirement savings accounts?

- Make your money last Do you have the right asset mix? And have you structured your finances to maximise government benefits? And what’s the best way to manage your debt?

- Do I pay tax in retirement? It depends on how the money went into your super, how you take money out and how old you are. We look at ways to minimise the tax impact.

- How much can I withdraw from super? What are the minimums and maximums you need to be aware of.

- Preparing for residential careLooking for aged care can be difficult and there’s lots to consider. Being aware means being prepared.

- Estate planningGood estate planning isn’t just about making a will. It’s a good way to take stock of your finances. Read more

For retirement planning advice in Hobart contact Premium Business Group on 03 6165 2666.

Wealth Protection

Total and permanent disablement (TPD)

TPD cover provides a lump sum if you become unable to work due to a permanent disability. This cover can help you pay for medical expenses, repay major debts and help provide for your future.

Trauma cover

Trauma cover provides a lump sum if you’re diagnosed with a medical condition or undergo a procedure outlined in your policy. This may include a heart attack, major organ transplant, cancer or stroke — to name a few. Trauma cover is designed to help cover your medical costs and living expenses, providing you with some financial security during the important recovery period.

Death cover

Death cover may be important for people of all ages, especially if you have others relying on you and large debts such as a mortgage. Death cover provides a lump sum to your beneficiaries if you die. This can be used to help meet the costs of your mortgage, other debts and/or cover your family’s future expenses. Many policies make an advance payment of the insured sum if you are diagnosed with a terminal illness. With Death, Total Permanent Disablement and Trauma cover you can:

- Find comfort in knowing your family will receive a lump sum payment to help them financially if you were to die or become terminally ill.

- Receive financial support if you become seriously disabled, maintain your quality of life and help meet the cost of rehabilitation programs and daily living expenses with TPD insurance.

- Take the financial pressure off and give yourself time to recover, should you experience one of the traumatic events listed in our trauma cover, including cancer, stroke, heart attack and coronary artery surgery. Children’s trauma cover can also be selected.

Income Protection Insurance

You insure your car, the family home and even your health – so why not your ability to earn an income. Have you ever thought about what would happen if you became ill or were injured and couldn’t work for an extended period of time? Would you be able to meet your financial commitments without your regular income? If not, it’s time you considered income protection. When you think about what life would be like without your regular income, your earning capacity becomes possibly your greatest asset. Chances are, you’ve based the achievement of your goals and ambitions on having a regular cash flow. If you became ill and were unable to work and maintain that cash flow, your goals may no longer be achievable.

Business Overheads Insurance

What would happen to your business if you were too ill or injured to work? Business Overheads Insurance helps you meet your ongoing business expenses by reimbursing eligible business overheads as a monthly amount if you are too ill or injured to work.

Protect your business expenses

Recover with peace of mind knowing that, if you are unable to work due to injury or illness, your business overheads insurance will reimburse your business expenses such as:

- Rent

- Property Rates

- Vehicle leases

- Salaries

Premium Business Group provides wealth protection advice in Hobart . Contact us on 03 6165 2666.

Wealth Protection

Insurance is the foundation of all financial plans. We can help you evaluate the risks and come up with the right insurance solution for you and your family.

Read More ....

Wealth Protection

Total and permanent disablement (TPD)

TPD cover provides a lump sum if you become unable to work due to a permanent disability. This cover can help you pay for medical expenses, repay major debts and help provide for your future.

Trauma cover

Trauma cover provides a lump sum if you’re diagnosed with a medical condition or undergo a procedure outlined in your policy. This may include a heart attack, major organ transplant, cancer or stroke — to name a few. Trauma cover is designed to help cover your medical costs and living expenses, providing you with some financial security during the important recovery period.

Death cover

Death cover may be important for people of all ages, especially if you have others relying on you and large debts such as a mortgage. Death cover provides a lump sum to your beneficiaries if you die. This can be used to help meet the costs of your mortgage, other debts and/or cover your family’s future expenses. Many policies make an advance payment of the insured sum if you are diagnosed with a terminal illness. With Death, Total Permanent Disablement and Trauma cover you can:

- Find comfort in knowing your family will receive a lump sum payment to help them financially if you were to die or become terminally ill.

- Receive financial support if you become seriously disabled, maintain your quality of life and help meet the cost of rehabilitation programs and daily living expenses with TPD insurance.

- Take the financial pressure off and give yourself time to recover, should you experience one of the traumatic events listed in our trauma cover, including cancer, stroke, heart attack and coronary artery surgery. Children’s trauma cover can also be selected.

Income Protection Insurance

You insure your car, the family home and even your health – so why not your ability to earn an income. Have you ever thought about what would happen if you became ill or were injured and couldn’t work for an extended period of time? Would you be able to meet your financial commitments without your regular income? If not, it’s time you considered income protection. When you think about what life would be like without your regular income, your earning capacity becomes possibly your greatest asset. Chances are, you’ve based the achievement of your goals and ambitions on having a regular cash flow. If you became ill and were unable to work and maintain that cash flow, your goals may no longer be achievable.

Business Overheads Insurance

What would happen to your business if you were too ill or injured to work? Business Overheads Insurance helps you meet your ongoing business expenses by reimbursing eligible business overheads as a monthly amount if you are too ill or injured to work.

Protect your business expenses

Recover with peace of mind knowing that, if you are unable to work due to injury or illness, your business overheads insurance will reimburse your business expenses such as:

- Rent

- Property Rates

- Vehicle leases

- Salaries

Premium Business Group provides wealth protection advice in Hobart . Contact us on 03 6165 2666.

WHY CHOOSE PREMIUM BUSINESS GROUP?

Exceptional Personal Service

We listen. Once we discuss your plans, we provide you with financial advice and services suited to your needs and goals.

Ongoing Support

Our proactive team keeps you on track to achieve your goals with regular check-ins.

Ease

You work with one advisor for your needs – cash flow, superannuation, investment, debt management, insurance, intergenerational planning, and estate planning.

A Holistic Approach

We find out what you want to achieve in life so that we can provide you with strategies to help you get there.

Knowledge and Experience

Our friendly team is highly qualified and experienced.

Latest News

Ready to retire… but not quite yet? We break down three reasons why a TTR…

Few investment sectors combine geopolitical intrigue, technological innovation and long-term growth potential quite like rare…

A sudden death can place financial stress on those who depend on you. If this…

A simple guide for investors and pensioners Australia’s latest dividends stream was flowing strongly recently…

-

About Us

About Us

Learn more about our teamCalculators

Access our library of handy calculatorsContact Us

Get in touch with our team